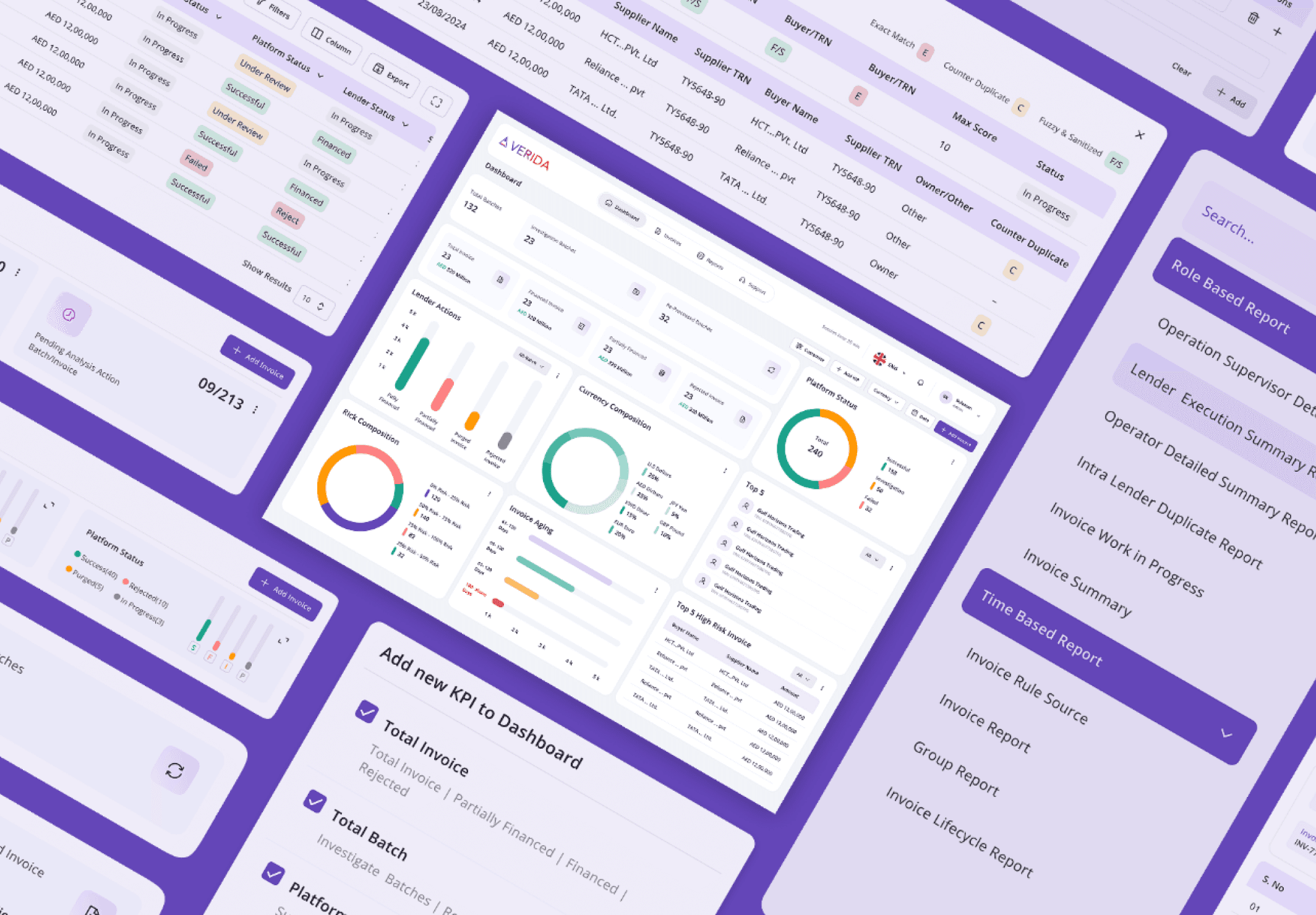

Revolutionizing Duplicate Invoice Management at Verida: UX Case Study

Verida is designed to address challenges in trade finance, particularly fraud detection and operational inefficiencies. Verida leverages advanced technologies such as blockchain and machine learning to provide real-time validation, authenticity checks, and secure document management.

Timeline:

8 weeks, Client Project

My Role:

UI & UX Designer

Deliverables:

Improve info. Architecture, Brand Identity, User Stories, Enhanced User Flow, Wireframes, Visual Enhancement, Prototype, Design System

Impact of Re-Design

75 %

Enhanced the accuracy and efficiency of duplicate invoice detection

Design Process

01

• Audit current portal - Identify pain points and usability issues.

• User Behavior - Analyze date and feedback.

• Data Analysis - Summarize insights into trends and priorities.

02

• Building Personas - Create detailed points and usability issues for the diverse needs of the user base.

• Features - Align with user need and goals.

• Information Architecture - Organize content for easy access.

• User Flow - Map journeys to streamline navigation.

03

• Ideation - Brainstorm concepts; sketch and validate ideas.

• UI Exploration - Experiment with visual style, layouts and interactions.

• Wireframe - Create low-fidelity and validate flows.

• Design System - Develop cohesive UI components and branding.

• Prototyping - Built and test interactive prototypes.

04

• Documentation - Create design handover documents, style guides, and component libraries.

• Developer hand-off - Share annotated design and prototypes with developers.

• Feedback loop - Address developer queries and ensure design ccuracy.

Client Consern

What’s stopping our banking users from making this portal part of their daily routine—and how can we make it indispensable to them?

What would make fintech and banking aggregators feel excited, confident, and eager to onboard—and how can we deliver that experience effortlessly?

UX Audit Insights

Design Feel Disconnected

The interface lacks a consistent visual language—like each page is speaking a different dialect. This breaks the flow and makes the experience feel patchy.

Navigation Feel Like a Maze

Finding your way around is harder than it should be. The current way finding tools don’t guide users clearly, leaving them guessing where to click next.

System Keeps Users in the Dark

There is little to no feedback when something's loading or processing. Users are left wondering,

"Is it working? Did i click the right button?"

Too Much Memory Work

Users are expected to remember things instead of being gently reminded. It’s like asking someone to recall a password they created years ago—frustrating and unnecessary.

Users Feel Boxed In

There’s little room for personalization or flexibility. Users can’t tweak things to suit their needs, which makes the experience feel rigid and impersonal.

Not Friendly to First-Timers

The portal assumes users already know how everything works. For newcomers, it’s like jumping into a movie halfway through—confusing and overwhelming.

Design Pain Points

Cluttered

User Interface

The current interface presents an overwhelming amount of information, making navigation and task execution difficult for users.

Unclear Workflows and Information Architecture

Users struggle to understand the flow of actions and how information is organized, leading to inefficiencies and errors.

Manual Identification of Duplicate Invoice

The Process of deleting duplicate invoices is entirely manual, resulting in increased workload and potrntial for oversight.

Problem Statement

Banking employees face significant challenges in managing duplicate invoices due to inefficient workflows. Confusing navigation, inconsistent terminology, and limited automation hinder duplicate detection, while inadequate feedback, cluttered data presentation, and restricted search options complicate the process, leading to errors and reduced efficiency.

Project Objective

• Elevate User Experience & Navigation

• Optimize Data Interaction

• Streamline Core Workflow

• Implement Advanced Search & Filtering

• Ensure Scalability & Adaptability

Strategic Goals

• Boost Operational Efficiency

• Improve Data Accuracy

• Increase Employee Productivity

• Suggort Business Growth

• Drive Innovation

User Persona

Sarah

Ahmad

Senior Banking Operations Specialist

Age: 34 years | Experience: Mid-Management | Technical Proficiency: High (Familiar with various banking softwares)

With over a decade of banking experience, Sarah is a detail-oriented trade finance specialist skilled in invoice financing, compliance, and risk mitigation.

Pain Points

• High-Volume Processing: Efficiently managing thousands of invoice daily under strict regulatory demands.

• Duplicate invoice Resolution: Inefficient identification and resolution of duplicate invoice lead to financial discrepancies.

• Complex Tracking: Difficulty managing invoice across multiple client and intricate financial structure.

"Efficiency and accuracy are my top priorities - I need tools that help me achieve both without compromising on security or compliances."

Key Objective

• Ensure Data Integrity & Accuracy.

• Maintain clear and organized audit trail.

• Mitigate financial risk and prevent fraud.

• Enhance overall operational efficiency.

Improvised Information Architecture

Improvements

Streamlined Invoice Submission

Elevated the invoice uploading experience by creating a clear, intuitive, and highly user-friendly workflow, minimizing processing time and errors.

Unified & Efficient Navigaton

Established a cohesive and logical navigation system throughout the portal, significantly enhancing user efficiency and content access.

Empowered User Support

Introduced a Support and Documentation section that helps users find answers and troubleshoot issues on their own.

Improvised User Flows

Improvements

Elevated Dashboard Usability

Re-engineered the hierarchy & interaction models for dashboard data points, ensuring a more intuitive & efficient user experience.

Enhanced Report Accessibility

Redesigned the report navigation flow to provide seamless access and improve overall user engagement with analytical tools.

Enhanced Portal

Optimize Data Grid

Functionality

Approach:

Introduced robust table interaction capabilities, such as configurable global and column-level filtering, alongside intuitive column rearrangement. These features enable user to tailor data views precisely to theie individual analytical needs

Impact:

By granting users profound control over data presentation, this enhancement drastically reduces information overload, minimizes search times, and directly contributes to a substantial uplift in data-driven decision-making and operational efficiency.

Proactive User Engagement &

Feedback

Approach:

Introduced a readily available, one-click feedback button designed for the swift submission of user issue suggestions or insights from any point in the workflow.

Impact:

By democratizing feedback submission, this functionality cultivates a highly responsive product environment. This significantly improves our ability to proactively address user needs, validate design assumptions, and drive targeted enhancements, thereby strengthening user loyalty and accelerating product refinement cycles.

Intentional Visual

Prioritization

Approach:

Developed a robust visual hierarchy system utilizing distinct color contrasts, dynamic font sizing for primary content, and purposeful image integration to direct user attention to key information intuitively. Strategic application of whitespace ensures visual clarity and prevents information overload.

Impact:

By guiding user focus effectively, this design ensures a highly efficient information processing pathway. This leads to an improved user experience characterized by faster task completion, deeper content engagement, and a reduction in user frustration typically associated with cluttered or disorganized interfaces.

Proactive Duplicate Invoice

Prevention

Approach:

Developed an intelligent automation module to continuously scan and flag potential duplicate invoices. The system operates on a robust set of predefined criteria (e.g., invoice number, vendor ID, monetary value) and provides real-time alerts for user validation.

Impact:

This core functionality elevates the reliability of the invoice management process, freeing employees from tedious manual verification and allowing them to focus on higher-value tasks. By systematically preventing costly duplicate payments and ensuring data consistency, it directly strengthens financial controls and significantly reduces operational risk.

Enhanced Information Grouping &

Navigation

Approach:

Developed a refined information architecture by thoughtfully consolidating related content and functionalities into intuitive, overarching categories.

Impact:

This strategic organization significantly streamlines the user journey, allowing for rapid access to required information. It minimizes user friction by presenting a coherent structure, leading to improved task completion rates and a more fluid user experience.

Seamless Data

Persistence

Approach:

Introduced an intelligent auto-save capability that systematically preserves all inputted data without manual intervention. This safeguards ongoing work against unforeseen disruptions, including network outages or technical glitches, ensuring no information is inadvertently lost.

Impact:

This core functionality guarantees an uninterrupted and highly reliable user experience. By proactively protecting data, it empowers employees to maintain focus on their tasks, eliminates the productivity drain associated with data re-entry, and reinforces the system's dependability for critical business operations.

Dyanamic & Configurable

Dashboards

Approach:

Developed a dynamic dashboard framework that grants users comprehensive control over their data insights. This includes the ability to select from a library of widgets, freely arrange their display, and apply granular data filters to construct a workspace optimized for their specific requirements.

Impact:

By enabling deep customization, this feature empowers users to create highly efficient, tailored views of their operational data. It directly leads to accelerated information assimilation, a more streamlined task flow, and a measurable increase in user engagement and satisfaction, ultimately driving better informed and faster business actions.

Optimized Workflow

Efficiency

Approach:

Simplified critical task flows by meticulously removing unnecessary stages and establishing a coherent, sequential user journey. Visual cues and embedded contextual guides were strategically integrated to support users through each step, ensuring seamless execution.

Impact:

By enhancing the directness and clarity of task pathways, this improvement empowers users to accomplish objectives with greater speed and accuracy. This translates to substantial gains in system proficiency, reduced reliance on external support, and a measurable uplift in overall user satisfaction and operational throughput.

Optimized First-Time User

Experience (FTUE)

Approach:

Implemented a concise and intuitive onboarding tutorial designed to seamlessly guide new users through the portal's core functionalities. This initial experience strategically familiarizes them with key features and navigational paradigms.

Impact:

This structured onboarding significantly enhances user adoption and proficiency from the outset. By pre-empting potential confusion and building foundational understanding, it empowers users to navigate the platform with confidence, accelerating time-to-value and fostering long-term engagement.

6446B8

Personal Reflections and Learnings

The Imperative for Modern Banking: Building Trust, Maximizing Workflow Efficiency, and Securing Future UX Through User-Centric Design.

Bringing Together Business Goals and What Users Want

Balancing business goals with user expectations was challenging. Through extensive research, I identified how UX could enhance engagement and retain users while meeting compliance and operational needs. The design solutions focused on simplifying usability and attracting customers.

Making Workflows Work Better and Faster

Money matters can get pretty complicated, but making things easier with better UX really boosts how happy users are. By cutting down on mental strain, simplifying those long verification steps, and adding clear feedback, I made sure that banking was smooth and hassle-free for everyone.

DESIGN IN ACTION

Explore More

Available for new projects

Let's make the digital world a better place together!

I'm always excited to collaborate on new projects and innovative ideas. Whether you have a question or just want to say hi, feel free to reach out!

Get in Touch