Coral is a Neobank catering to corporate banking.

Coral brings effectiveness, efficiency, and excellence to all financial processes. With coral neobanking businesses get access to fully-functional multiple accounts, currency branches, vendor management, and automate payroll compliance.

Initial Design Brief

To design a website for corporate banking that enhances the user experience, which is intutive and helps to manage their daily tasks conveniently.

Design Process

Secondary Research

In the Research and Analysis Phase, according to the initial design brief, secondary and primary research was carried out. It helped in gaining a clear understanding of the service the company is providing, the demand in the market, competitors analysis, and users pain points, journeys, tasks.

What is a Neobank?

Neobanks are financial technology firms that offer internet-only financial services and lack physical branches. Neobanks don’t have a bank license of their own but count on bank partners to provide bank-licensed services.

What is a corporate banking?

Corporate Bank operations are financial operations that involve enterprises, corporations, government organizations and other significant institutions. They are conducted by both retail and investment banks. Many of those operations are general banking activities such as deposit taking, lending and e-banking.

Features

Transactions, Settlements, Invoices, Payments, Customers, Bulk Payments, Employer Services, Corporate INB

Information Architecture

Studied the information architecture of business neobanks to understand the features provided, the user journey and the hierarchy of the web application.

Banks considered for competitor analysis

InstantPay

Razorpay

SBI Business

Open

NiYo

Mercury

Secondary Research Insights

Business Banking represents perhaps the most important growth segment for banks. And yet, most banks seriously underperform when it comes to servicing business customers, primarily because banks don't really understand their needs.

Customers expect to be able to do everything online, having a complete digital experience in opening their accounts, making transactions and enrolling in new services.

The best possible self-service experience can be ensured by biometric authentication, online forms, step-by-step guides, FAQs, DIY videos, knowledge bases, online advisory support, advanced scoring, etc.

Heuristic Analysis

Conducted Heuristic Analysis on ‘CHASE’ and ‘Razorpay’. It helped in understanding the visibility issues, discovering ambiguity with individual elements, and focusing on those issues.

Primary Research Insights

All the established and small enterprise owners have a business account in commercial banks like SBI, ICICI Bank, Axis Bank, Hdfc Bank.

The users face problem of delay in foreign transactions as it takes a lot of time in transit.

Frequently used features - NEFT/RTGS, Salary payments, Payments / Settlements / Refunds, Account details, Bulk payments, UPI, Insurance, Forex card.

Most of the employees have salary accounts in the same bank because of partnership with the bank.

The users keep track of the bulk order and amount manually, using a different software or through banking transactions.

The salaries to the employees are paid through bulk payments or individual payments through NEFT/RTGS.

Target Audience

The target consumers are entry-level corporates, MSME’s and SME’s.

Companies with employees ranging from 200-1000.

User Persona

Experience Journey Mapping

Pain Points

The customers are tired of the long onboarding process (Filling forms, uploading documents, etc.)

Users with multiple accounts in a single bank find it challenging to switch between various accounts.

They find it difficult to manage the customers and the amount that needs to be sent and received for different locations.

It is a tedious task for the business owners to keep track of the employee service, subscriptions, managing reimbursements, accounts & their rights.

Customers with businesses at different locations find it difficult to manage accounts of different locations and currencies.

Managing tax audit, insurances, loan/insurance, project financing, share holding, asset custody is a major task.

Final Design Brief

To design a website for corporate banking that enhances the user experience, which is intuitive and helps to manage their daily tasks and multiple currency transactions conveniently.

Card Sorting & Information Architecture

The card sorting research method was helpful to identify pain points and improve the Information Architecture

Ideation

Ideated and designed concepts on the pop-up interaction, quick switch between accounts, the list view of the transactions, and the sidebar interaction.

Wireframes

Style Guide

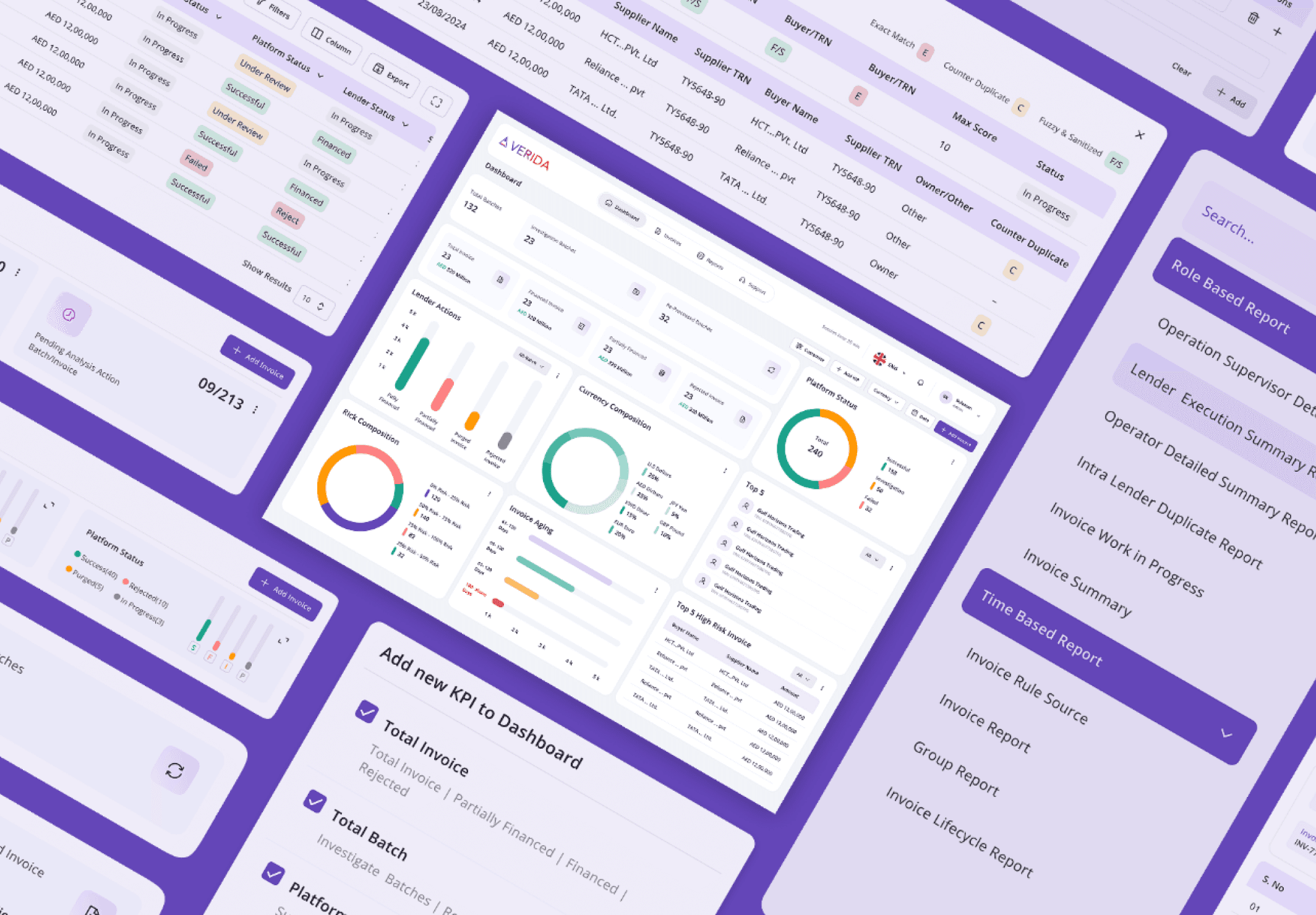

Enhanced Portal

Dashboard

•

Account details

•

Recent transactions

•

Analytics

•

Quick transactions

Dashboard

•

Switch branches and accounts

•

Add accounts

Accounts

•

View all accounts and associated currency branches details

•

Freeze and unfreeze accounts

•

Quick currency converters

Transactions

•

Manage payments, refunds, beneficiaries

•

Schedule Payments

•

Quick Filters

New Payment

Payment Successful

•

Share Receipt

Payouts

•

Manage payouts, items and vendors

Receivables

•

Manage receivables, products, customers

•

Send invoices and receipts

Payroll

•

Manage employee details

•

Create payroll

•

Manage reimbursements

Dispense

•

Dispense money received in a particular account to multiple other accounts automatically

Profile

•

Manage profile details, company details, verification, invoice details, and complete KYC

Settings

•

Preview of the theme color, company logo, signature on the invoice

•

Notification setting

Help

•

Search FAQ’s

•

Chat with the support team or get a call from them to resolve an issue

Help

•

Raise a support ticket to resolve the issue

•

Check the status of the ticket

Personal Reflections and Learnings

Placing users first, simplifying financial complexities, and refining the experience through iterative design and collaboration.

Embracing User-Centric Design

Through this project, I recognized the paramount importance of placing users at the heart of the design process. Conducting in-depth research, user interviews, and usability studies helped me uncover real pain points and expectations. By prioritizing clarity, ease of use, and accessibility, I was able to design solutions that not only aligned with business goals but also enhanced user satisfaction. This experience reinforced the idea that great UX is built on empathy, and every design decision should be driven by a deep understanding of user needs.

Iterative Design and Testing

The iterative process of prototyping and user testing reinforced the necessity of flexibility in design. Early-stage wireframes and prototypes allowed for quick validation of ideas, reducing the risk of costly redesigns later. Regular usability testing sessions provided actionable insights, helping refine workflows, improve interactions, and eliminate friction points. Embracing feedback—both from users and stakeholders—ensured that each iteration moved the design closer to an intuitive, seamless, and efficient final product. This project emphasized that UX is an ongoing process of learning, adapting, and improving.

Explore More

Available for new projects

Let's make the digital world a better place together!

I'm always excited to collaborate on new projects and innovative ideas. Whether you have a question or just want to say hi, feel free to reach out!